Real Estate News Digest

PRIVATE NEW HOME SALES

Excerpt from our January 2026 Monthly Private New Home Sales Report.

January’s New Private Home Sales Signal Steady Start to 2026; Demand for New Executive Condominiums Holds Up

Developers’ sales rebounded in January led by select new project launches during the month. New home sales came in at 466 units (ex. EC), more than doubling the 197 new units transacted in December 2025 and marking the highest new sales tally in three months.

Archives:

Sales Analysis December

2025

Sales Analysis November

2025

Sales Analysis October

2025

Sales Analysis September

2025

Sales Analysis August

2025

Sales Analysis July

2025

Sales Analysis June

2025

Sales Analysis May

2025

Sales Analysis April

2025

Sales Analysis March

2025

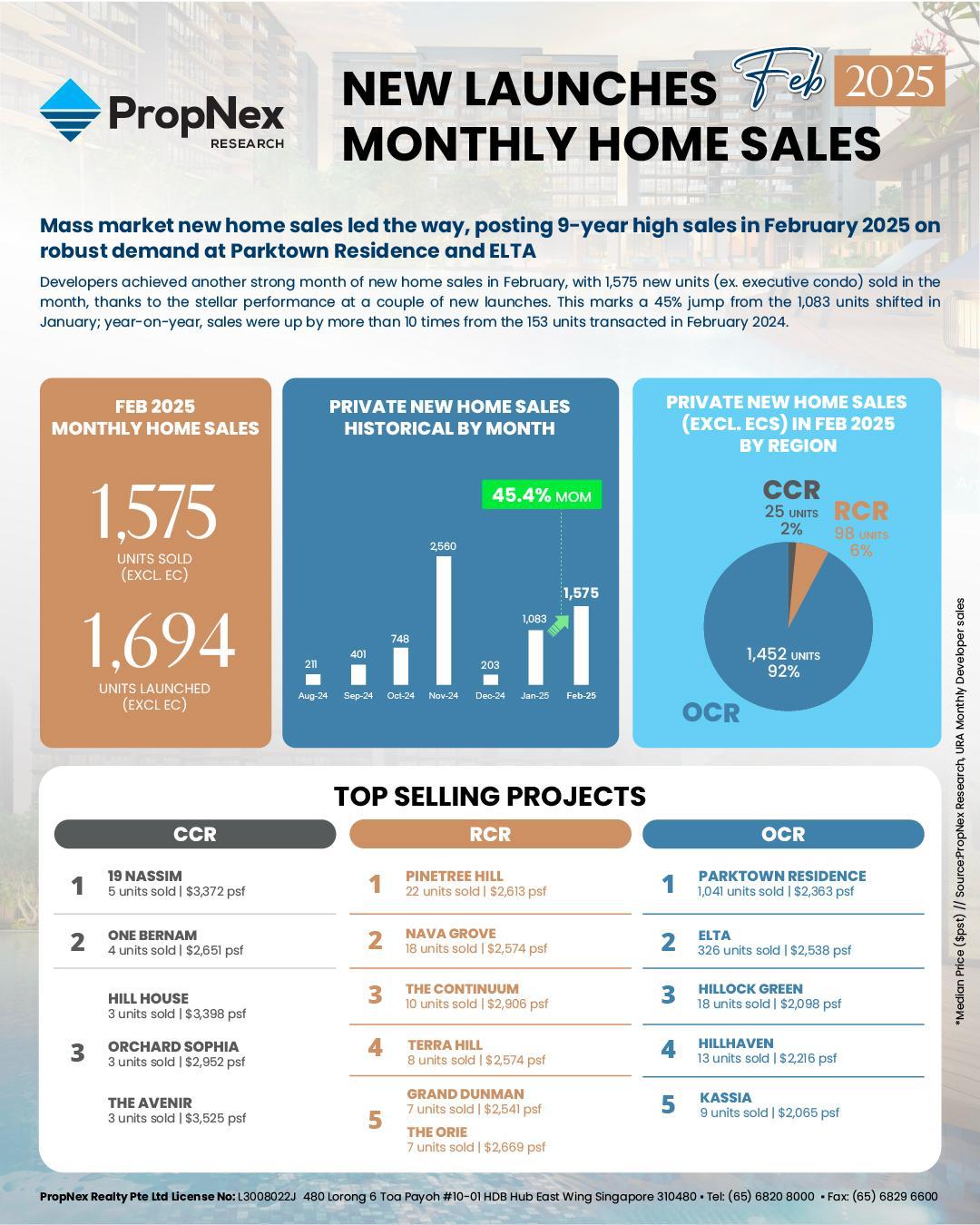

Sales Analysis February

2025

Excerpt from the PropNex Residential Report Q3 2025

In Q3 2025, private home prices rose at a slight faster pace compared with the previous quarter. A slew of attractive new launches in Q3 2025, including several projects in the city, has helped to prop up private home prices in Q3, posting the fourth consecutive quarterly increase. Developers have launched an estimated more than 4,000 new units in Q3 2025.

To read the report above in more detail, download report Propnex Q3 2025 Report

Archives:

Propnex 2Q 2025 Report

Propnex 1Q 2025 Report

Propnex 1Q 2025 Residential Report

Annex

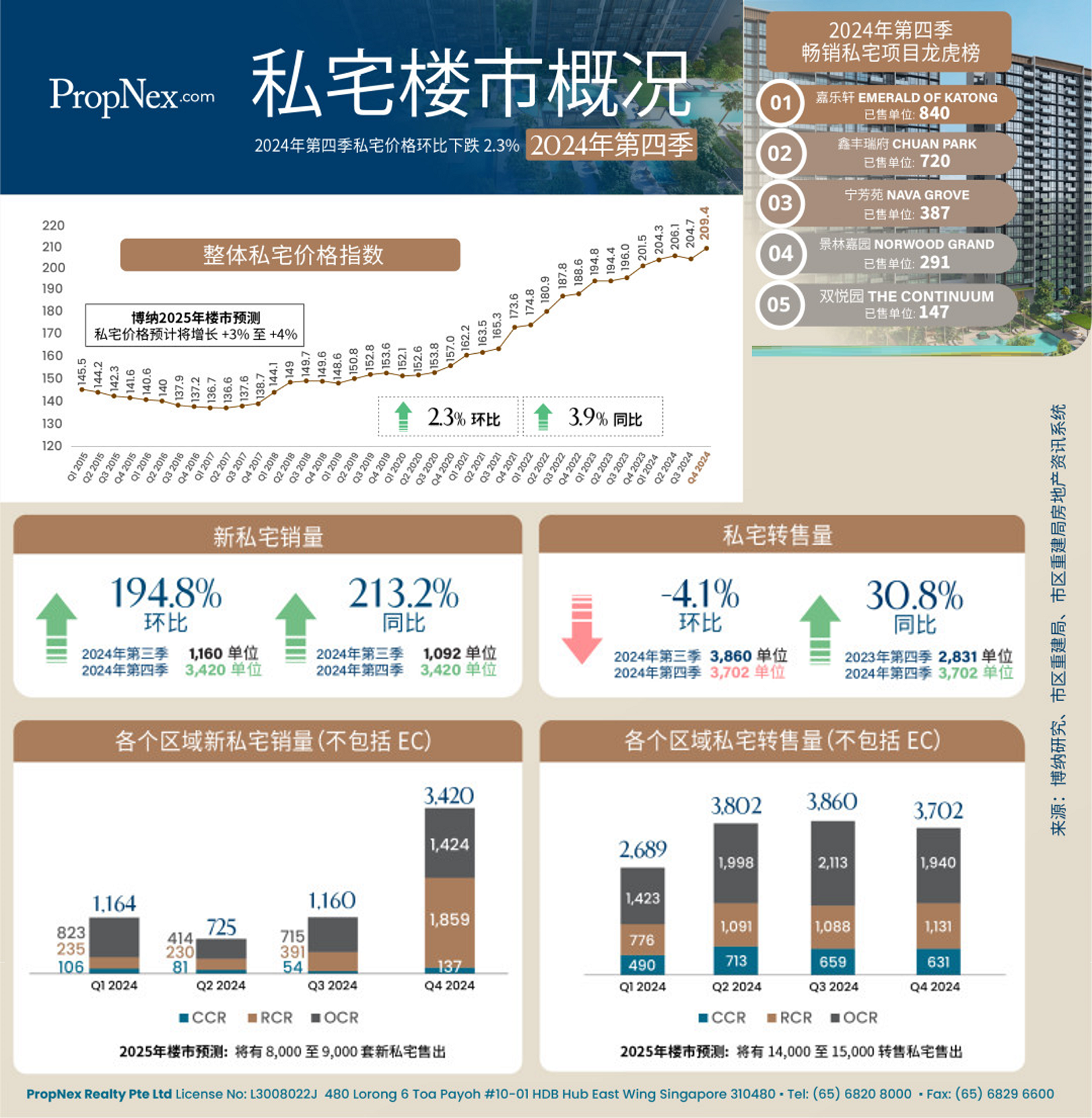

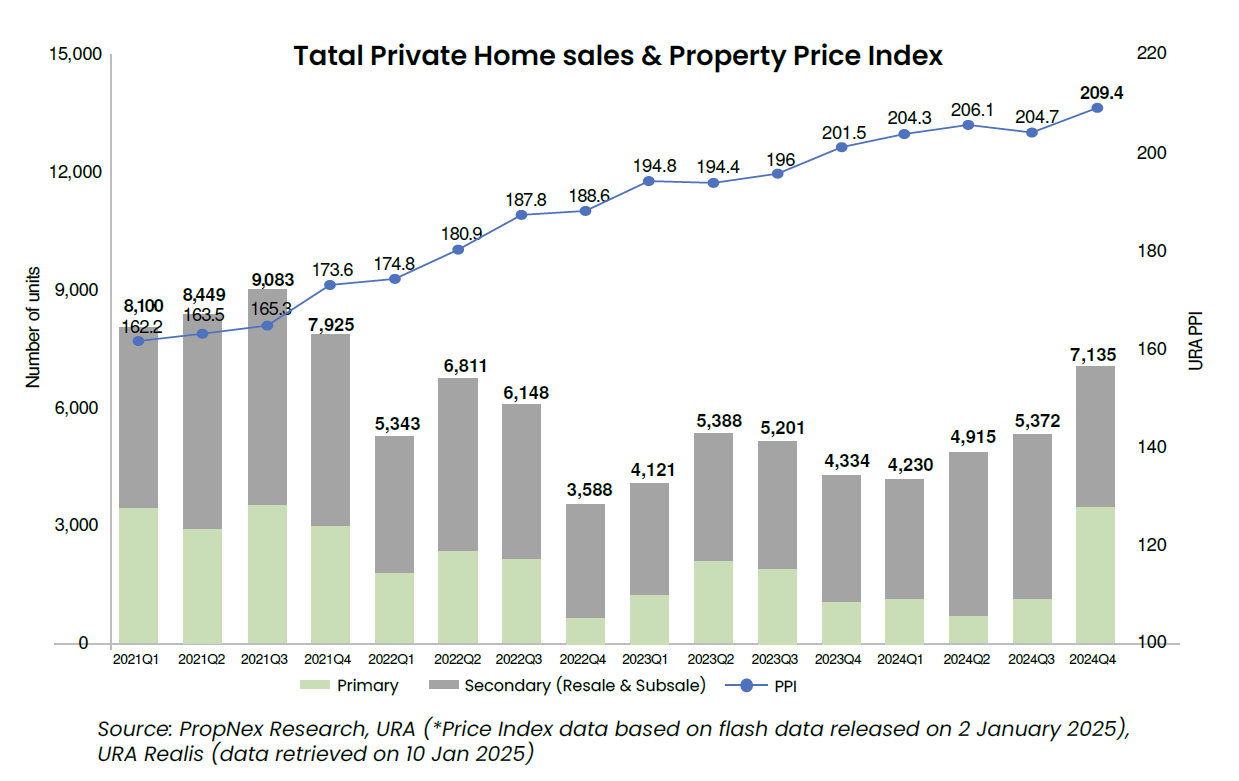

Propnex 4Q 2024 Report

Propnex 4Q 2024 Residential Report

Annex

Propnex 4Q 2024 Report

Propnex 3Q 2024 Residential Report

Annex

Propnex 2Q 2024 Report

Propnex 1Q 2024 Report

Propnex 1Q 2024 Residential Report

Annex

Propnex 4Q 2023 Report

Propnex 4Q 2023 Residential Report

Annex

Propnex 3Q 2023 Report

Propnex 3Q 2023 Residential Report

Annex

Propnex 2Q 2023 Report

Propnex 2Q 2023 Residential Report

Annex

Propnex 1Q 2023 Report

Propnex 4Q 2022 Report

Propnex 3Q 2022 Report

Propnex 3Q 2022 Residential Report

Annex

Propnex 2Q 2022 Report

Propnex 2Q 2022 Residential Report

Annex

Propnex 1Q 2022 Report

Propnex 1Q 2022 Residential Report

Annex

Propnex 4Q 2021 Report

Propnex 4Q 2021 Residential Report

Annex

2024 RESIDENTIAL PROPERTY MARKET OUTLOOK REPORT

PropNex Research’s latest outlook report for projections of the Singapore residential market in

2024.

Much of the uncertainties that raised caution in the market in 2023 are expected to persist into 2024, at least in the first half of the new year. Geopolitical tensions, macroeconomic headwinds, rising costs and high interest rates will continue to influence housing demand and risk appetite. Where interest rates are concerned, there is a likelihood that they may stabilise further, with some observers predicting the US Federal Reserve could start to trim rates from June 2024.

In addition, the Monetary Authority of Singapore has in October 2023 said that the Singapore economy is projected to improve gradually in the second half of 2024, and that Q3 2023 “likely marked the turning point in the slowdown”. Meanwhile, the labour market remains tight and unemployment rate is low which will help to support the housing market.

To read the report above in more detail, download report

PRESS RELEASE

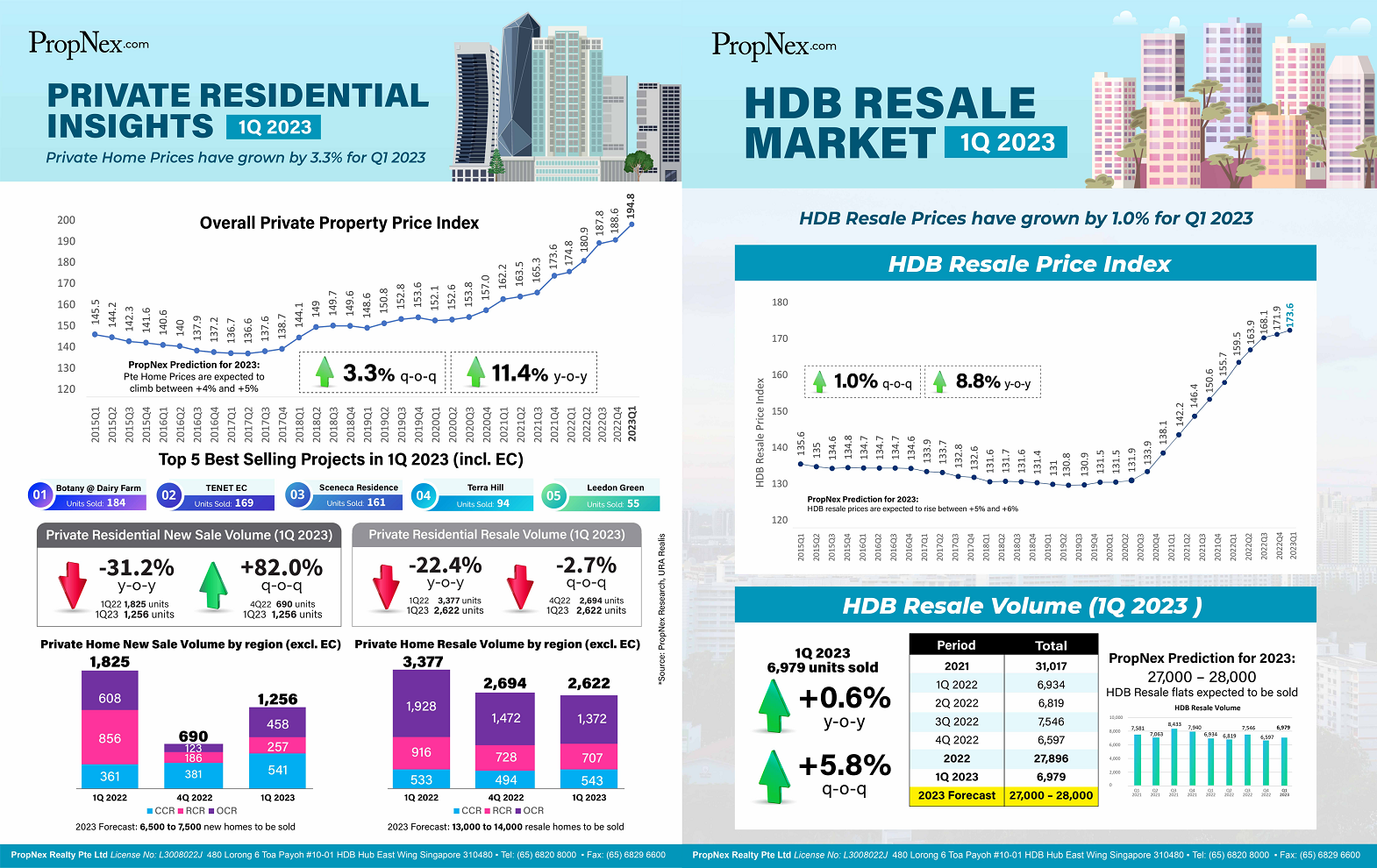

Latest infographics & analysis on the newly announced Q1 2023 Private and HDB Resale Market data

Private home prices have grown by 3.3% for Q1 2023. Meanwhile, HDB Resale prices have also grown by 1.0% for Q1 2023. PropNex predicts 27,000 to 28,000 HDB resale flats to be sold for 2023.

Check out our full analysis here

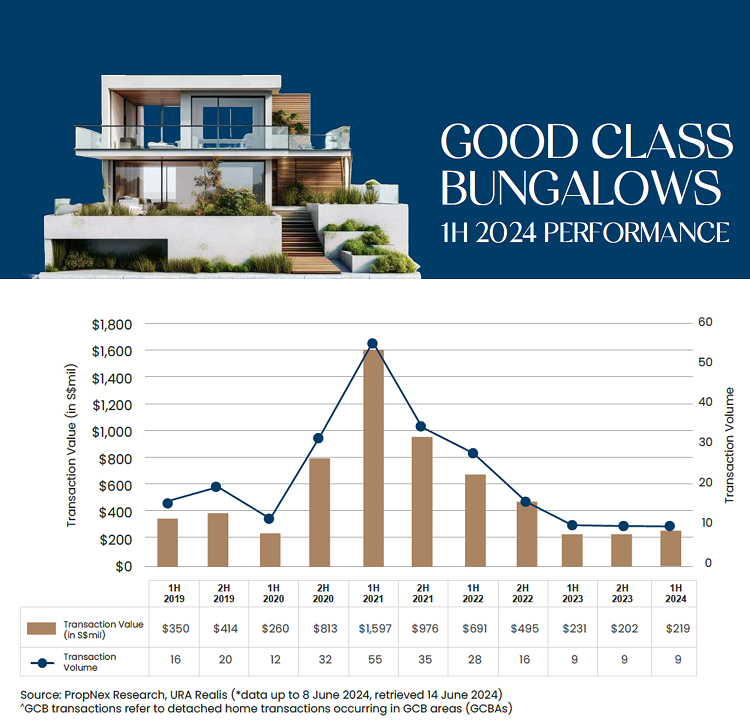

Excerpt from the PropNex Residential Landed Report for 1H 2024. Excerpt from the PropNex GCB & PRESTIGE LANDED Report for 1H 2024.

Sales activity of landed homes remained relatively resilient, as buyers shake off market uncertainties

and the still-high interest rates to pick up private landed residential properties. There were 681

landed home transactions overall - totalling $3.7 billion – in 1H 2024 (till 8 June), looking on track

to better the performance in 2H 2023, as well as 1H 2023. The improvement in sales is seen to have

supported landed home prices.

The Good Class Bungalow (GCB) segment was also livelier in 1H 2024, with more big-ticket deals being reported – about nine deals worth about $219 million were recorded, based on caveats lodged.

To read the report above in more detail, download reportArchives:

Propnex 2H 2023 GCB & Prestige Landed Report

Propnex 1H 2023 GCB & Prestige Landed Report

Propnex 2H 2022 GCB & Prestige Landed Report

Propnex 1H 2022 GCB & Prestige Landed Report

COMMERCIAL & INDUSTRIAL

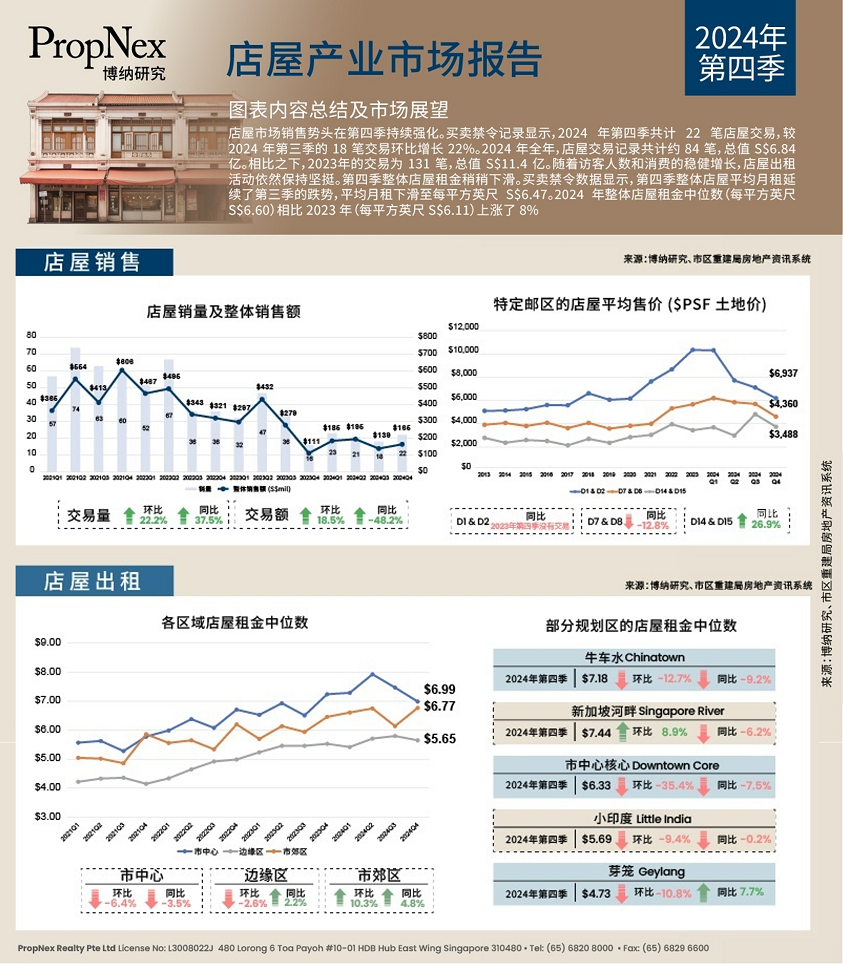

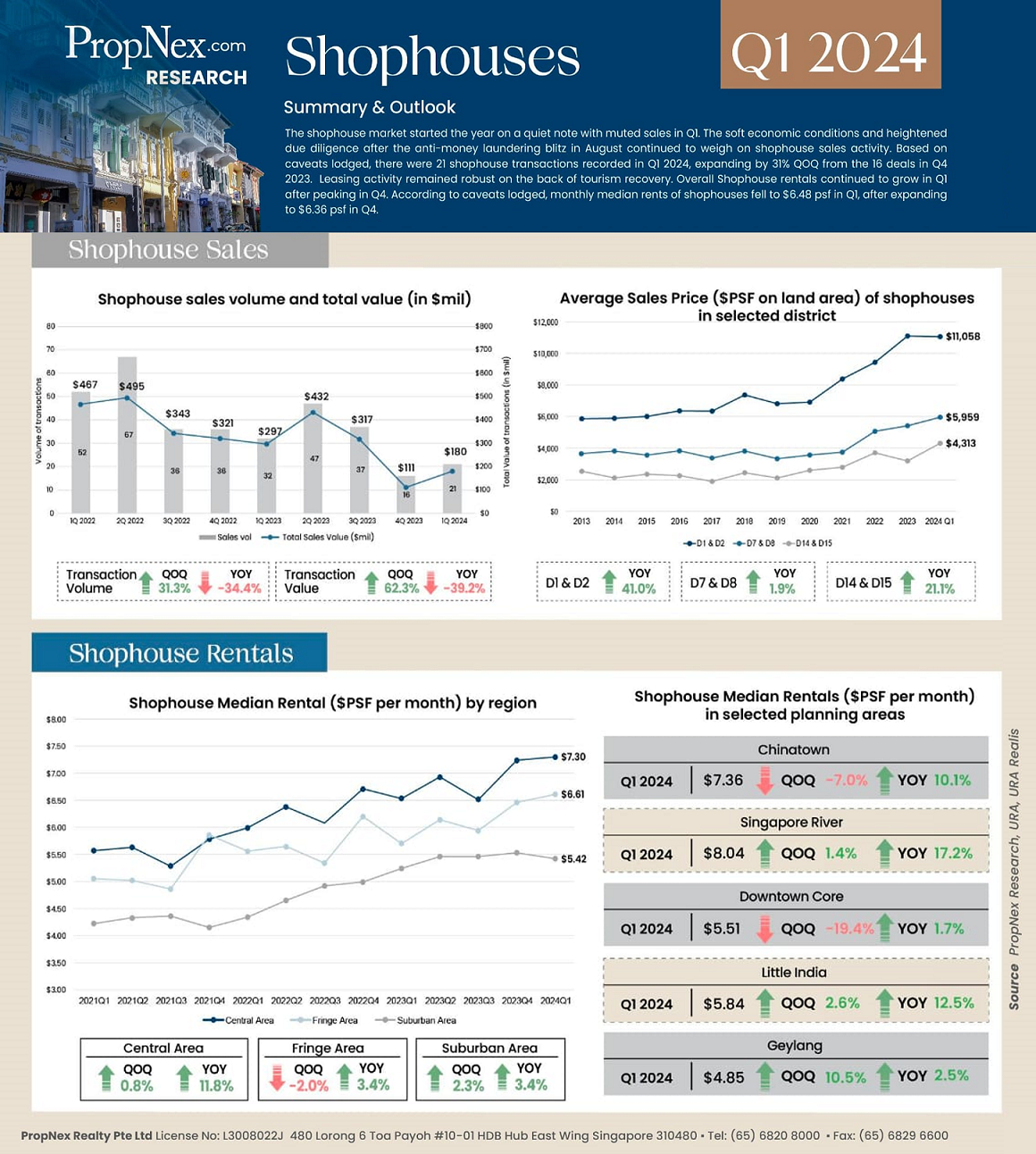

Excerpt from the Q1 2024 Shophouse Report

Shophouse transactions were still relatively muted in the quarter, amid the cautious market sentiment, mismatch in pricing expectations, and tighter due diligence checks likely dragging out the sales process. However, market observations indicate that investment interest in commercial shophouses remains keen.

To read the report above in more detail, download report Propnex 1Q 2024 Shophouse Report.and Annex, download report

Archives:

Propnex 4Q 2023 Shophouse

Report

Propnex 4Q 2023 Shophouse

Report Annex

Propnex 3Q 2023 Shophouse

Report

Propnex 2Q 2023 Shophouse

Report

Propnex 3Q 2023 Shophouse

Report

Propnex 4Q 2022 Shophouse

Report

Propnex 4Q 2022 Shophouse

Report Annex

Propnex 3Q 2022 Shophouse

Report

Propnex 3Q 2022 Shophouse

Report Annex

Propnex 2Q 2022 Shophouse

Report

Propnex 2Q 2022 Shophouse

Report Annex

Propnex 1Q 2022 Shophouse

Report

Propnex 1Q 2022 Shophouse

Report Annex

Excerpt from the PropNex Commercial Report Q4 2024

Office market investment sales regained some momentum in Q4 2024, after a brief slowdown in Q3 -- driven by a flurry of strata office transactions during the quarter including One Sophia, an upcoming mixed-use development which injected a fresh supply of new strata office units into the market. Despite a pick-up in office investment sales, office prices and rentals eased in Q4 2024.

To read the report above in more detail, download reportArchives:

Propnex 3Q 2024 Commercial Report

Propnex 3Q 2024 Commercial Annex

Propnex 2Q 2024 Commercial Report

Propnex 2Q 2024 Commercial Annex

Propnex 1Q 2024 Commercial Report

Propnex 1Q 2024 Commercial Annex

Propnex 4Q 2023 Commercial Report

Propnex 4Q 2023 Commercial Annex

Propnex 3Q 2023 Commercial Report

Propnex 3Q 2023 Commercial Annex

Propnex 2Q 2023 Commercial Report

Propnex 2Q 2023 Commercial Annex

Propnex 1Q 2023 Commercial Report

Propnex 1Q 2023 Commercial Annex

Propnex 4Q 2022 Commercial Report

Propnex 4Q 2022 Commercial Annex

Propnex 3Q 2022 Commercial Report

Propnex 3Q 2022 Commercial Annex

Propnex 2Q 2022 Commercial Report

Propnex 1Q 2022 Commercial Report

Propnex 1Q 2022 Commercial Annex

Propnex 4Q 2021 Commercial Report

Propnex 3Q 2021 Commercial Report