The two main factors which determine your ability to own a private property (or HDB) are Eligibility & Affordability.

Before you step into a show flat (or resale market), it is good to have a basic understanding of your Buying/Holding Power and the Payment Process.

This guide will allow you to have an idea of the estimated value of the property that you could comfortably afford.

当你决定想拥有私人房产或政府组屋,两个主要考虑因素是政策符合和负担能力。

当你踏入展销厅(或转售市场)之前,最好先了解您的可负担能力和付款流程。

本银行借贷指南让你对可贷项款百分比有个概念。

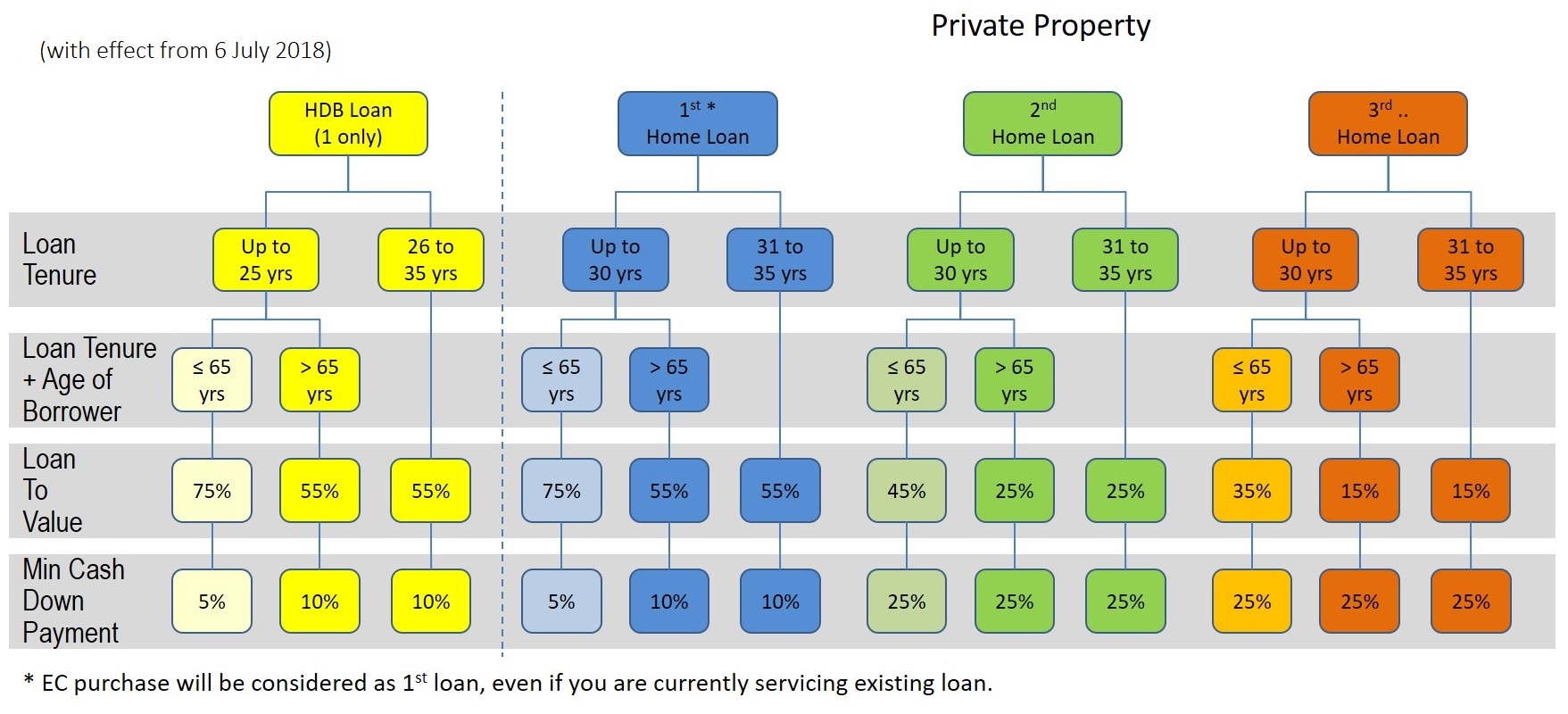

Firstly, you'll need to find out the percentage of 🏦Loan you could possibly borrow from a bank, e.g. 50%, 60%, 75%, etc. This will determine how much Cash💵 and CPF💲 components you need for the purchase.

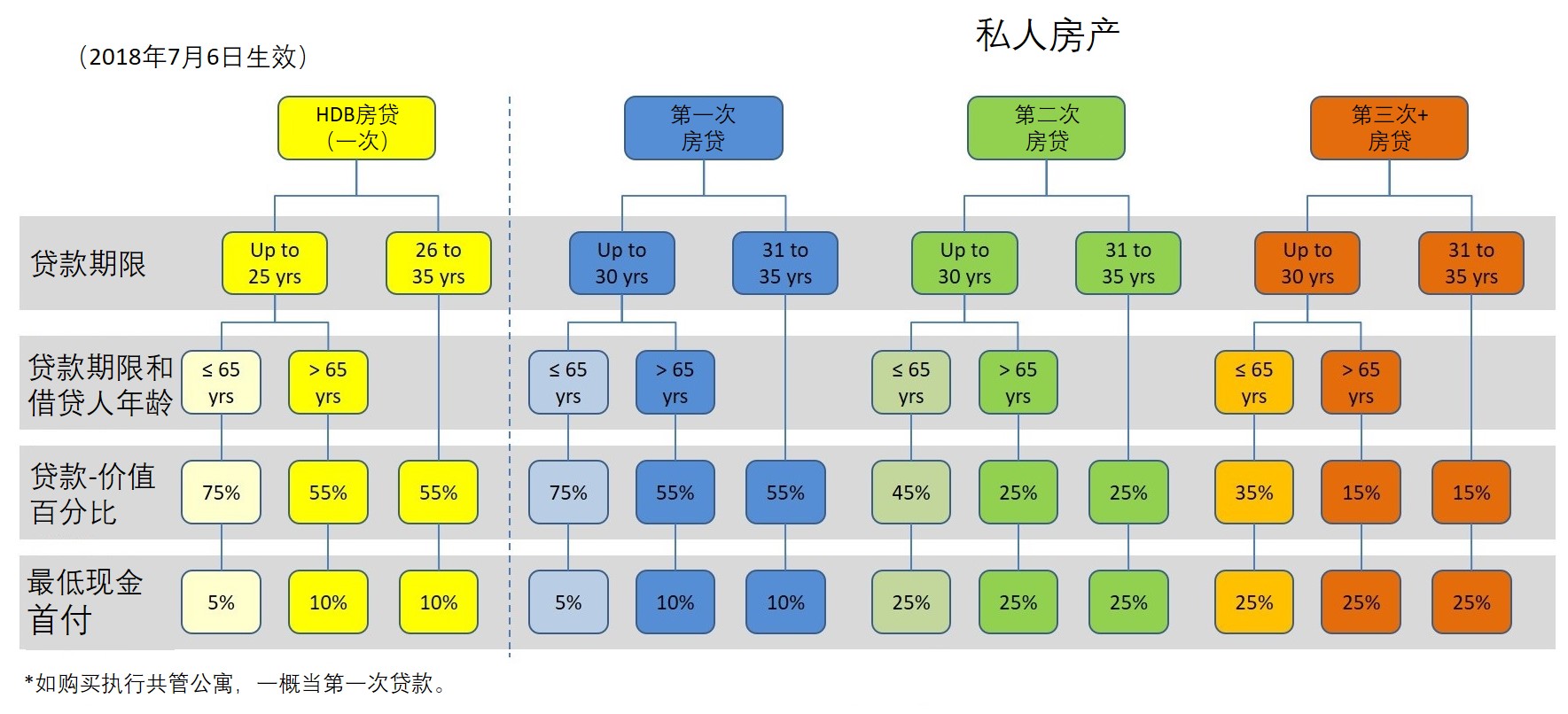

首先,您需要知道能从银行🏦借贷款项的百分比,例如50%,60%,75%等。这将确定您需要预备多少 现金💵和公积金存款💲。

Firstly, you'll need to find out the percentage of 🏦Loan you could possibly borrow from a bank, e.g. 50%, 60%, 75%, etc. This will determine how much Cash💵 and CPF💲 components you need for the purchase.

首先,您需要知道能从银行🏦借贷款项的百分比,例如50%,60%,75%等。这将确定您需要预备多少 现金💵和公积金存款💲。

You may want to use the various Financial Tools available here like Affordability Check to understand your financial prudence on the commitment.

您可以使用这里提供的其他计算工具如 Affordability Check(可负担能力测试)来了解您所将要投资项目的可行性。

If you require assistance, do not hesitate ot contact us at

如果您任何疑问,请随时与我们联系

✆+65 6100 1170 📱+65 9066 6966 (Cyan Ho 何永全) 📱+65 9465 8080 (Ruth Low 刘锦仪)

If you require assistance, do not hesitate ot contact us at

如果您任何疑问,请随时与我们联系

✆+65 6100 1170 📱+65 9066 6966 (Cyan Ho 何永全) 📱+65 9465 8080 (Ruth Low 刘锦仪)